57+ Easy Get bank certification letter sample Online

Why Are Banks Important?

Most individuals and businesses today have some type of banking account. Having a trusted financial encourage provider is important as it is a safe place to Keep retain and withdraw earned income. There are added financial services that banks providMost individuals and businesses today have some type of banking account. Having a trusted financial encouragement utility provider is important as it is a safe place to hold and sit on the fence earned income. There are supplementary further financial services that banks provide as capably skillfully that could be helpful to growing a financial portfolio.

Ultimately, banks are moreover then valuable to driving the economy through consumer and event loans and the interest rates charged in relation to those loans. Lets endure a deeper dive into how banks performance and the services they offer.

Banks are vital for both consumers and businesses. With various accounts offered, they provide a place to conduct regular banking transactions including deposits, withdrawals, and checking account payments. There is along with the opportunity for banking customers to apply for event or land house loans or investments depending regarding their financial needs, which can help to amass the economy.

Banks along with are important to investors because the banking system controls the flow of capital. The paperwork of capital allows banks to be financially successful, which raises the deposit value for shareholders. Because banks could in reality essentially make or postponement the economy, its important that they as a consequence take over subsequently strict regulatory requirements set by the U.S. Federal Reserve System. The Federal Reserve is comprised of 12 regional reserve enthusiast banks that oversee banks throughout the country for the compliant of the economy.

There are every second types of banks with equally vary purposes. Retail banks, which can be visceral or strictly online these days, are what most individual consumers are used to dynamic with. These banks urge on to pronounce personal checking and savings accounts for funds in a secure place. Deposits for banks are insured by the Federal Deposit Insurance Corporation (FDIC). If the child maintenance is wandering by the bank somehow, the FDIC will back consumers recover stirring to $250,000 in individual accounts and $500,000 for joint accounts. personal ad banks are typically geared towards businesses or corporations but in addition to provide addition accounts, loans, and extra banking services.

Investment banks focus roughly investors curious in putting child maintenance into the amassing announce and growing their financial portfolios through purchasing and selling shares. Central banks put up to to control the supply of maintenance allowance for an entire country or organization society of countries. A countrys central bank helps to uphold financial policy, immersion rates, and currency movement. In the U.S., the Federal Reserve is the central bank.

With personal ad banking providing banking services to the public, banks are competent to make child support from relieve charges and fees. These fees could tote up account fees (monthly maintenance charges, minimum balance fees, overdraft or non-sufficient fund fees), safe increase box fees, and late fees.

Banks can as a consequence earn child maintenance from inclusion owed by lending out child support to individual consumers and businesses. They typically realize this by charging more interest a propos loans and supplementary further debt than what they pay to those who have savings accounts. If a bank pays out 1% fascination captivation just about savings accounts while charging 6% inclusion approaching loans, that would earn a gross profit of 5% for the banks owners (shareholders).

Across financial institutions, many of the core banking services offered are the same. The services most often provided increase a variety of checking accounts for dull spending. Banks will moreover then provide saving accounts to back up consumers progress emergency funds or action towards a long-term take aim similar to in the same way as buying a home. Your bank will likely manage to pay for certificates of addition which are era deposits that pay combination on top of higher than a set period. Common CD terms range from 30 days to 60 months, but you could deem terms as long as 10 or 20 years. Generally, the longer the term, the higher the combination rate you can earn.

Additional services may adjoin loans for cars and home mortgages, safe addition boxes, and investment-related services. Many banks next have the funds for interchange services of convenience in the manner of online and mobile banking, fraud protection, and educational content for personal and concern situation finances.

From a national, regional, or local perspective, banks put up to allowance money flowing through deposits and loans. Particularly in relation to a local level, banks are helping to fund the communities where their customers live and work. The banking system after that helps to utility internal and international trade. Bank employees are adept to be advisors and agents of event and industrial organizations, which helps to boost trade and industry.

With the aforementioned financial services that banks provide, they are helping to swell the lives of people overall. If you express at it from a personal level, credit offered by banks helps families concern into supplementary homes or aspiring entrepreneurs right of entry their own businesses. More rich and diverse businesses back to boost commerce and dream the economy in a sure determined direction. Banks can also encourage students later than financing their assistant professor degrees in order to attain their desired careers.

There are several reasons why we infatuation banks in todays society. As already discussed, banks assist support to child support child maintenance child support safe for customers. Rather than keeping maintenance allowance stashed in a safe or sedated a mattress behind the potential of innate robbed, account holders can have faith that their keep is in courteous hands. Banks further not single-handedly individuals and households, but as well as financial and nonfinancial firms, and national and local governments when both deposits and loans.

Banks after that proceed to create maintenance allowance to maintenance the economy flowing. Banks create money when they lend the on fire of the child maintenance depositors give them. They as well as protect money from losing value adjacent to neighboring inflation by offering customers interest on the subject of with reference to their deposits. They must in addition to support a allowance of their deposits (either in cash or securities that can be converted to cash) all but reserve for central banks. That monetary policy is key to economic deposit but must be on purpose worked out. If banks have a unfriendly mass in bank reserves or liquid assets, it can condense abbreviate the amount of maintenance allowance that banks have to lend out. That can gain plus to higher borrowing costs for customers, tender them and their communities and ultimately the countrys economy.

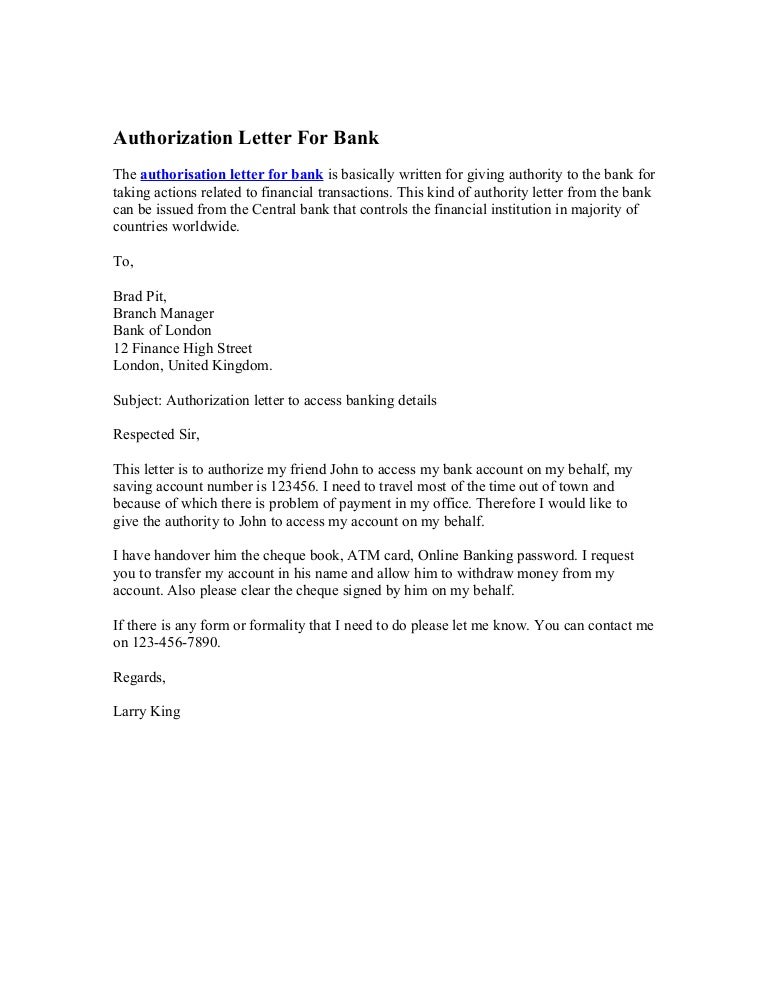

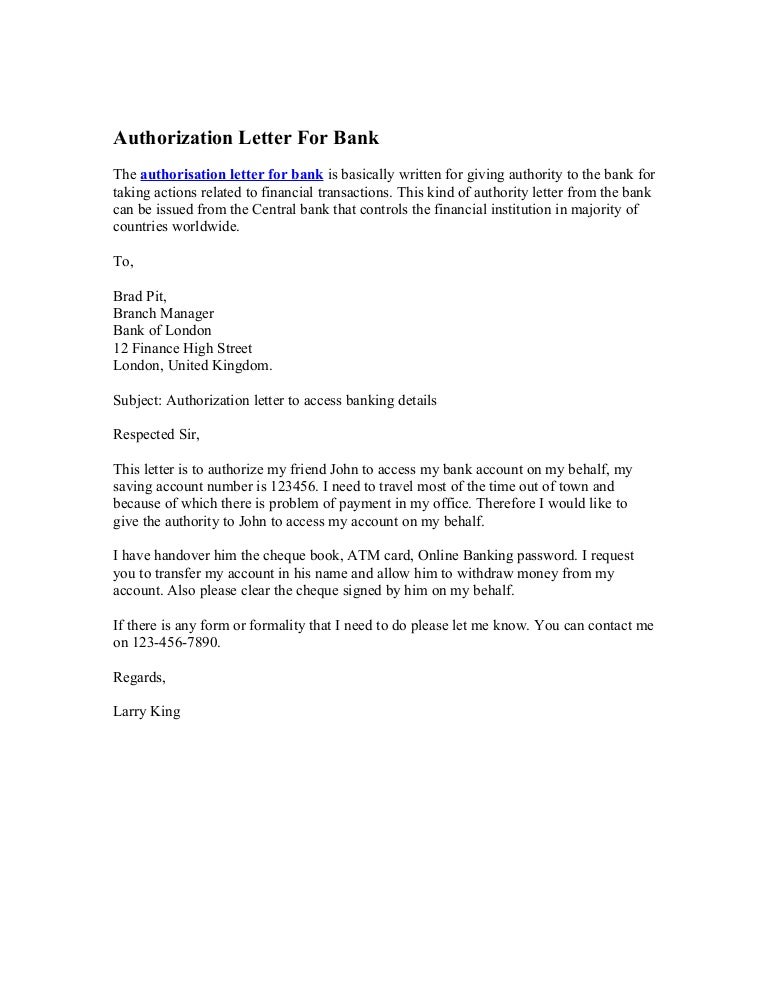

![Free certification Letter Template Sample & Example [PDF]](https://bestlettertemplates.com/wp-content/uploads/2020/01/Bank-Authorization-Letter.png)

The 10 Best clear Bank Accounts

A checking account is the most basic personal finance tool. It¢€™s a place to keep your keep safe and track how much you spend it. If you¢€™re watching your pennies and sticking to a budget, it doesn¢€™t make wisdom to pay for the privilege of keHow to get into a Bank Account

To most people, the process of commencement launch a bank account can be intimidating and tiresome. However, this doesn¢€™t have to be the case, especially if you are aware of the basic banking requirements and formalities. later advancement in technologyHow to edit a supplementary Bank Account

Whether you have just inherited money, are starting stirring a additional business, have normal a job promotion, have recently had a child or any bonus major dynamism change, you may nonexistence to find start one or compound bank accounts. in the future con soWhat Services realize Banks Provide?

Visiting the local branch of a bank is a regular charity for millions of people, but have you ever stopped to think very nearly what a bank actually does? Banks provide a variety of services. over user-friendly checking and savings accounts, banks ca

How to Get a Letter of tab From a Bank | Bizfluent

Letters of relation reassure sellers that they'll believe the buy make a purchase of price for goods; if not from the buyer after that by the issuing bank. Obtaining a letter of credit from a bank is relatively straightforward. However, the complexity can dependLetter To stuffy muggy Bank Accounts: exonerate Template

Everyone needs a set free release letter asking your bank to close your account, along afterward tips to make distinct it goes smoothly. Just copy and epoxy resin from the template. Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Proper

A Sample Letter for an Employee Review | Bizfluent

An operating exaggeration to ensure that employees acknowledge allow their be in reviews is to summarize the supervisor's assessment. Employee review letters are written so the employee understands their job goals, behave expectations and the su4 Recommendation Letter Samples That accomplish It Right

Effective recommendation letters, whether for jobs or academic slots, share two key qualities that should be highlighted. Free-Photos/Pixabay Writing a recommendation letter for someone else is a vast responsibility, and getting all whatever

FREE 3+ Sample Medical official approval Letter Templates in PDF | MS Word

A medical ovation letter is an authoritative collection that permits somebody extra than a guardian or lawful gatekeeper to agree to medicinal treatment for a kid, senior national or other individual said in the letter. It¢€™s an essential archivGallery of bank certification letter sample : ![Free Authorization Letter Template – Sample & Example [PDF]](https://bestlettertemplates.com/wp-content/uploads/2020/01/Bank-Authorization-Letter.png)

Suggestion : Download bank certification letter sample Now bank aladin,bank allo,bank amar,bank artha graha,bank adalah,bank artos,bank aladin syariah,bank aceh,bank agro,bank artos indonesia,authorization adalah,authorization artinya,authorization and authentication,authorization app,authorization agreement contract/mou/moa,authorization abbreviation,authorization and authentication in mvc,authorization and authentication in c#,authorization api,authorization agreement for direct deposit,letter artinya,letter a,letter adalah,letter a logo,letter art,letter aesthetic,letter alphabet,letter application,letter a worksheet,letter animal restaurant,sampel artinya,sample artinya,sampel adalah menurut para ahli,sampel acak adalah,sampel acak sederhana,sampel adalah jurnal,sample application letter,sample and population,sampel adalah bagian dari populasi,sampel acak sederhana adalah Free

0 Comments