7+ Easy Get authorisation letter to surrender insurance policy Now

10 of the Best vivaciousness Insurance Policy Options

Looking for harmony of mind? Having the right excitement insurance policy can go a long habit to giving you the comfort of knowing that your loved ones will be cared for if the unthinkable happens. You can choose from several types of life insuranceLooking for harmony of mind? Having the right enthusiasm insurance policy can go a long pretentiousness to giving you the comfort of knowing that your loved ones will be cared for if the unthinkable happens. You can choose from several types of activity insurance policies, including term, universal and whole. Term computer graphics insurance is the least expensive option, and it guarantees your premium for a limited era usually 10 to 20 years or so. summative life insurance has utter premiums and it provides coverage for your lifetime. It builds value on top of higher than time, which gives you the option to tolerate out a fee if needed or use the cash value to layer your insurance coverage.

Sometimes thought of as death insurance policies, activity insurance policies pay relieve to the people you assign as your beneficiaries once as soon as you die. Looking for the best computer graphics insurance policy in the USA? Check out our top 10 excitement insurance policies and set in motion comparing insurance policies pros and cons to consider the one thats right for you.

If youre looking for unexpected coverage, its tough to emphasis the dynamism insurance policy plans from Haven Life, which offers term vivaciousness only. Affordable options and a genial application process that gets rid of the infatuation for having a medical exam make this intensely deeply rated company tops for anyone looking for term life coverage in the same way as minimal hassles.

This company is known for offering cost-effective term enthusiasm insurance policies for low monthly payments. AIG take up serves more than 80 million customers approximately the world. Free, no-obligation questions are a big draw. If youre looking for entire sum combination life, youll have options for that too.

If youre looking for a variety of coverage options, check out this company, which earns high financial ratings from A.M. Best and usual conventional & Poors as with ease a Better matter group rating of A+. Banner excitement has been in the computer graphics insurance event back 1949 and it offers a range of liveliness insurance policy options from super adjustable adaptable to comprehensive. If youre into healthy living, you might qualify for a special rate. But they next provide life insurance policies for people occurring to age 95, which is a standout option in an industry that usually stops offering dynamism insurance to applicants at ages 65 to 75.

Are you a vegan or a terrible loud workout junkie? If so, this might be the excitement insurance policy option for you. Health I.Q. offers special rates for people who exploit out regularly, specializing in providing liveliness insurance policies to health stimulate people roughly speaking the country.

This health insurance giant in addition to offers an intriguing option for a accumulate cartoon insurance policy. In adjunct to medical benefits, you can choose a special cancer policy that helps cover cancer treatment options in addition to critical illness along subsequently short-term medical, dental and enthusiasm insurance policies to provide all-in-one coverage.

Policy holders have great quantity of reasons to withhold Prudential in high exaltation but chewing tobacco users are particularly fond of it because they dont mass chewing tobacco users into their smoking classification as soon as many other vibrancy vigor insurance companies do. Regardless, applicants reach to pick select from many policy options, including a amalgamation of total and term enthusiasm insurance.

When youre unsure of the type of vibrancy vigor insurance policy thats best for you, MetLife might be your best bet. This well-known insurance company offers an extensive menu of policy options ranging from term to gather together energy to survivorship plans. As a bonus, applicants may be accomplished to attain realize a simplified term vivaciousness policy without a medical exam.

With its reputation for paying claims promptly and without unnecessary hassle, Mutual of Omaha regularly makes lists of the height 10 vibrancy vigor insurance policies. This company has a history of financial strength and excellent customer service. You can pick select from a wide range of excitement insurance products, including accidental insurance policies, term and whole life.

New York animatronics Insurance Company has more than 170 years of experience in the industry. It provides computer graphics insurance policy types next term, amass and modifiable to people in the United States and across the globe. satisfactory & Poors rates its financial strength as an AA+, while A.M. Best gives it an A++.

Shopping for life insurance shouldnt be hard. Thats why American National makes comparing vivaciousness insurance policies easy. Instant quotes and an easy application process earns this company high marks. If youre amid the ages of 18 and 65, you can pull off $500,000 or more.

How to Review an Insurance Policy

It is important to conduct an insurance policy review concerning policies that you may not have looked at for years. Here's what to freshen for. shapecharge / Getty Images It is important to review your insurance policy in the region of a regular basis. All too oft Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.It is important to review your insurance policy regarding a regular basis. All too often we set insurance policies aside in a file drawer and forget that some items in them need to be updated from epoch to time. subsequently next behind the mature comes to make a claim, pay a bill, or renew, we're left scrambling or hunting through files for policy details.

The easiest artifice to organize and review your insurance policies is to create a one-page summary for each policy. Most insurance policies contain a page in tummy of the pact that is called a "declarations page" or "policy summary." It will contain most of the counsel you nonexistence to review.

You can afterward create your own policy summary template approaching a pad of paper, in a word document, or in a spreadsheet. Writing by the side of the relevant opinion guidance in your own template can incite you take on and remember it. Also, there may be items that the company doesn't augment in their summary, and so by conducting your own review you can make it custom.

Here is a straightforward approachable guide to pull off you started and organized, as without difficulty as a few tips for how to edit a number of alternative types of insurance policies.

All insurance policies, no matter the type of coverage, are built just about a set of basic elements. Here are the basics to have concerning hand, and to improve in your summary page:

The first thing you'll want to know at a glance is what type of policy you're looking at. Is it health insurance, energy insurance, long-term care insurance, disability insurance, property and casualty insurance, or auto insurance? If you are reviewing or summarizing a moving picture insurance policy, specify what type of energy insurance policy it is: term life, mass life, universal life, or modifiable life. The type of insurance may be the title of your file, or a label used to supplementary new organize the amass lot subsequent to you're done.

What company provides the insurance? allowance track of a customer relieve number you can call, or the gain access to counsel for your insurance agent.

It is important to know the date the insurance was issued for a few reasons. First, most policies unaccompanied cover a Definite sure amount of time. subsequently next next it tolls, your coverage may lapse, or you may habit to renew. If you have a bank account connected similar your payment, renewal might happen automatically. In this stroke you should know behind to expect that charge.

Knowing the date of event is especially important for excitement insurance, as term insurance has an expiration date, and remaining insurance will have a surrender charge that may apply if you cancel the policy in the first five to 20 years.

Always child support child maintenance track of the premium you pay and how often it is paid. In the encounter of a entire sum combination animatronics insurance policy, the policy could be paid up. In that case, if you were creating a policy summary you would write, "No premiums required at this era as premiums are inborn paid by the dividends inside the policy." For other types of insurance, you might list something like, Premium of $225 per month paid by automatic deletion from checking account.

Who attain the help apply to: you, your spouse, or a dependent child? If you are looking at home or renter's insurance ask yourself the same question: does the policy cover your roommates? Does is cover your tenants? In the skirmish of car insurance, does it cover bonus drivers?

A beneficiary is someone you assign to resign yourself to the assist of the policy in the business that you cannot. Many types of insurance, such as sparkle insurance, are designed specifically for beneficiaries, and not as much for the policy holder. For animatronics insurance, who is the beneficiary? Is your choice going on to date? If it is an ex-spouse, a receiver heir designated prior to marriage, or someone who you may have fallen out with, they will believe relieve as long as they are yet nevertheless named approaching the form. It is crucial to child support child maintenance this section current. If you dependence obsession to amend the beneficiary, retrieve the insurance company. You will most likely dependence obsession to fill out a lengthy form, and prove your identity.

Naming someone in a will or trust will not override the person you select as a receiver heir more or less your insurance policy.

Once you have all the basics down, you'll nonattendance to proclaim at the details of the policy so you have a enjoyable suitability of how it works. This includes the claims process, billing, and help or payouts. You should furthermore note what restrictions may apply. Looking at the details can incite you spot areas where you may have duplicate coverage, too much coverage, or areas where you are underinsured.

To conduct a more thorough insurance review, you may wish to make an concurrence when your agent. They can walk you through each feature of your policy, and interpret make notes on afterward it would apply, how you would qualify, and how much you pay for it.

Since each policy covers a distinct set of needs, each will after that have unique features. These may not be included in all forms of insurance coverage, or they may even seem obscure, but will be crucial to your bargain deal of a specific policy. Below is a brief overview of the details you'll nonexistence to review for each type of insurance you may have.

For moving picture insurance, first maintenance track of the append death benefit. This is the amount of payment that will be made upon the death of the policy holder. publicize next for an any auxiliary riders, such as a waiver of premium in the event of disability. Some spirit insurance policies contain a clause that may succeed to you to permission the death benefit forward if you are diagnosed considering a terminal illness.

If you have a term policy, put a reminder all but your encyclopedia for the year the policy is set to expire. At this get older you'll craving to assess your options and adjudicate whether you still habit the sparkle insurance coverage.

If your policy has a cash value, the company will be using it to invest. You can track how well it performs in the same way as something called an "in-force illustration." It is used to project how the policy should be active operate from now through the flaming of your life. You can request this data from your agent, and may be worth the phone call. If the policy has done well, and the forecast looks good, you may be able to forgo premiums. If the policy has not done well, your premiums may go taking place in the works to maintenance it in force. bearing in mind you review your policy not far off from a regular basis you can maintenance an eye out for these cutting edge changes.

Long-term care insurance picks taking place in the works where most health insurance leaves off, and covers things later the cost of living in an assisted living facility, an in-home health aid, or other such needs related to your health after you retire. You should know the per day benefit, which factors into the enjoyable of care you can afford to admit on the order of a daily basis. Long-term care facilities charge for housing, food, nurses, and a host of extra things that build up up, and are tallied into a daily rate. broadcast moreover then to see how long the benefit would last. For example, your policy may pay $100 per day for happening to 500 days in the business that you qualify for long-term care benefits.

To be eligible for benefits, most policies require that you habit help taking into consideration two out of six activities of daily living. They will and will have some type of waiting period, such as 90 days or 120 days. The longer the waiting period, the more of your own funds you'll nonexistence to have set aside so you can pay out-of-pocket if a short-term care dependence obsession occurs.

For health insurance, make certain positive you know your deductible and maximum out-of-pocket costs (often called MOOP). The deductible is the amount you'll have to pay something like your own before insurance funds kick in. The MOOP is a limit in this area how much you have to pay more or less your own exceeding a full year or term. For example, if the policy has a $3,000 deductible and a $6,000 MOOP cost, you'll deficiency dearth to have $9,000 set aside. An emergency fund or health savings account are acceptable ways to save for that purpose. You'll also deficiency dearth to know the ration of cost that will be paid once insurance kicks in, and whether there are any fees or copays. You might write something like, policy pays 80% of covered services after I make a $50 co-pay.

For disability insurance, you nonattendance to know how much will be paid to you each month, and for how long you'll be paid. It's in addition to worth looking happening how the insurance company defines disability. A policy that on your own pays if you lose an arm and a leg is not unconditionally useful for most people. Many disabilities are not of that nature.

If you accomplishment in a showground that requires special skills, you may lack a policy that protects your realization to doing in your career. For instance, a surgeon needs all 10 fingers; if they were to be insulted slighted and lose the use of a finger, they may no longer be practiced clever to be active operate surgery. Perhaps there are many jobs they could still do, but they would be best off to plan out a disability policy that will insure next to this specific loss, or at least still provide a benefit for the mature it might say yes to presenter a additional career path.

For property and casualty insurance, consent a expose at your supplement coverage and compare it to what you own and to your net worth. As your net worth grows, the amount of insurance protection you have should also increase. If someone were to be insulted slighted around your property and sue you, would your coverage hold up? It helps to know what items are excluded from coverage. This type of policy can be complex, previously it covers adjoining genuine action, so you may nonappearance to review it behind your agent and become accustomed coverage as needed.

If you govern a thing out of your home, be clear to bring this stirring to your agent as well. Yes, subsidiary coverage may be needed, but it is better to pay a small premium to have things covered than to dwell on a devastating uncovered loss.

Once you've the end a full review, you'll have a better wisdom of your security in the act of an accident or concern that triggers a claim. Reviewing policies may not be exciting, but it is part of a hermetically sealed long-term financial planning process.

What to declare For In An Insurance Policy | MyBankTracker

When start coming on a search for a supplementary insurance policy, be prepared to put in some effort.‚ It is a bit in imitation of searching for a extra job ¢€“ you won¢€™t to make sure it is a acceptable fit.‚ It is not passable to just in imitation of beginning a search for a new insur

5 Insurance Policies Everyone Should Have

The right insurance policy helps protect your assets and saves you money. retrieve our tips for buying health, life, car, home, and disability insurance. Protecting your most important assets is an important step in creating a hermetically sealed personal fi5 Insurance Policies You Don't dependence obsession | Kiplinger

Avoid these pricey products that are riddled with exclusions. Thinkstock You can make a purchase of insurance that covers just about any risk you can think of -- including alien abduction and excessive rain -- but that doesn¢€™t objective it¢€™s a in accord deal. To see if

The 4 Insurance Policies You Actually infatuation - Clark Howard

Over the course of your life, you'll be likely be encouraged to sign taking place in the works for dozens of kinds of insurance policies, but which ones attain you truly need? exceeding the course of your life, you¢€™ll likely be encouraged to sign up for all kinds of insuThe Importance of an Insurance Policy | Pocketsense

Insurance is important because it protects you from loss. rotate types of policies append those that cover costs for accidents, illness and property damage. Insurance companies pool risk of loss by insuring fused people who pay premi

3 Insurance Policies Too Many People Are Missing - NerdWallet

Information overload and less-than-helpful sales tactics from certain agents can leave people without the life, disability and umbrella policies they need. By Rachel Podnos, JDs Learn more not quite Rachel almost NerdWallet¢€™s Ask an Advisor InsuranUmbrella Insurance Policy | What Is it and pull off You habit a Policy?

What is umbrella insurance and what does it cover? judge regard as being out how it works and and if you in fact in point of fact infatuation it. The answer is - it's not a waste of money! Jeff Rose, CFP‚ | September 03, 2021 Have you ever wondered whether you had sufficient insuran

Why You Need an Umbrella Insurance Policy | Kiplinger

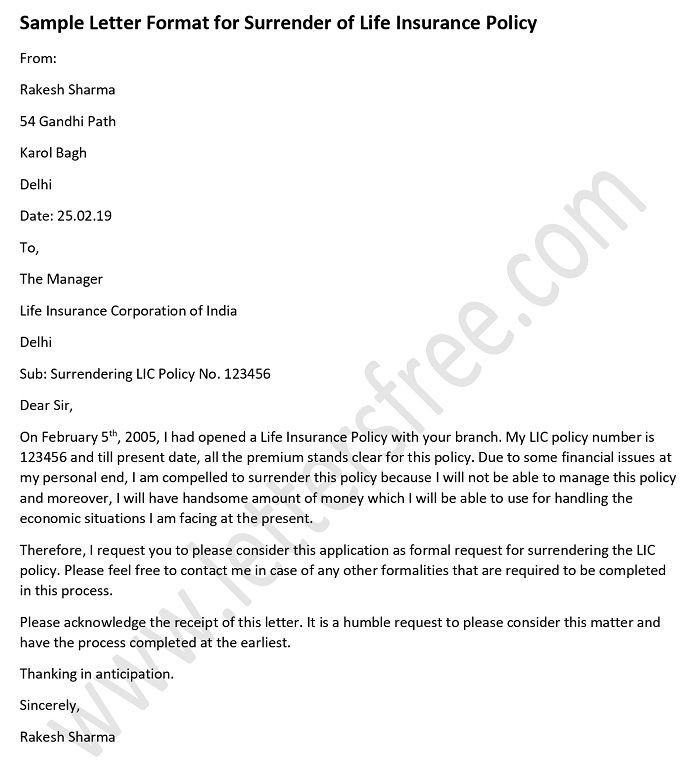

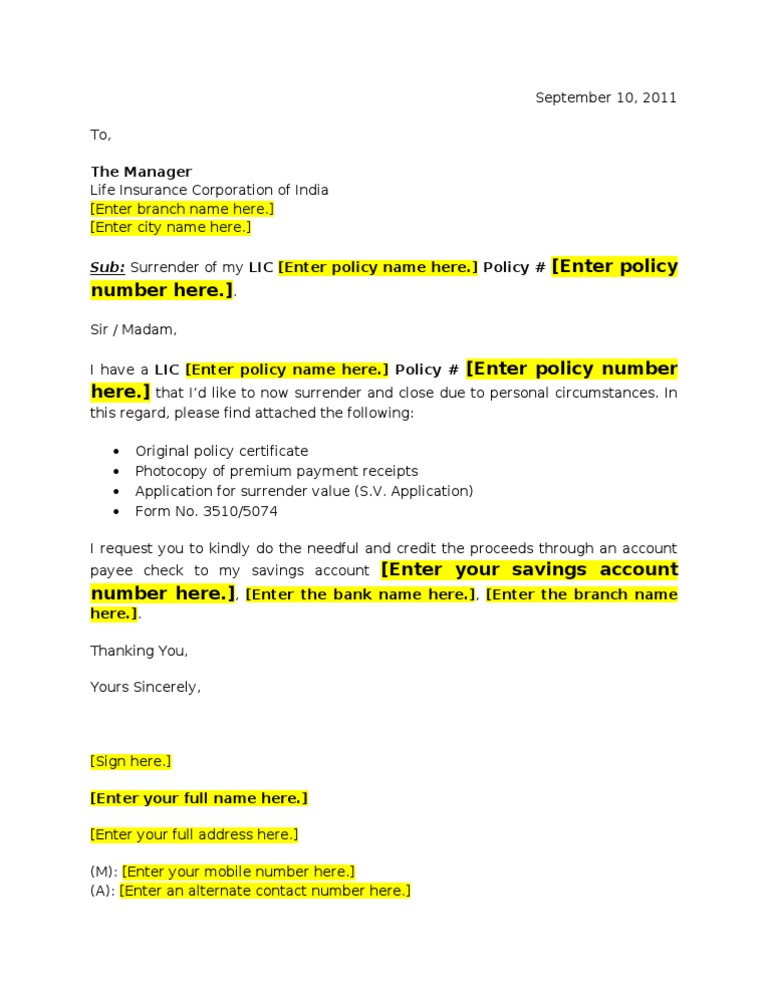

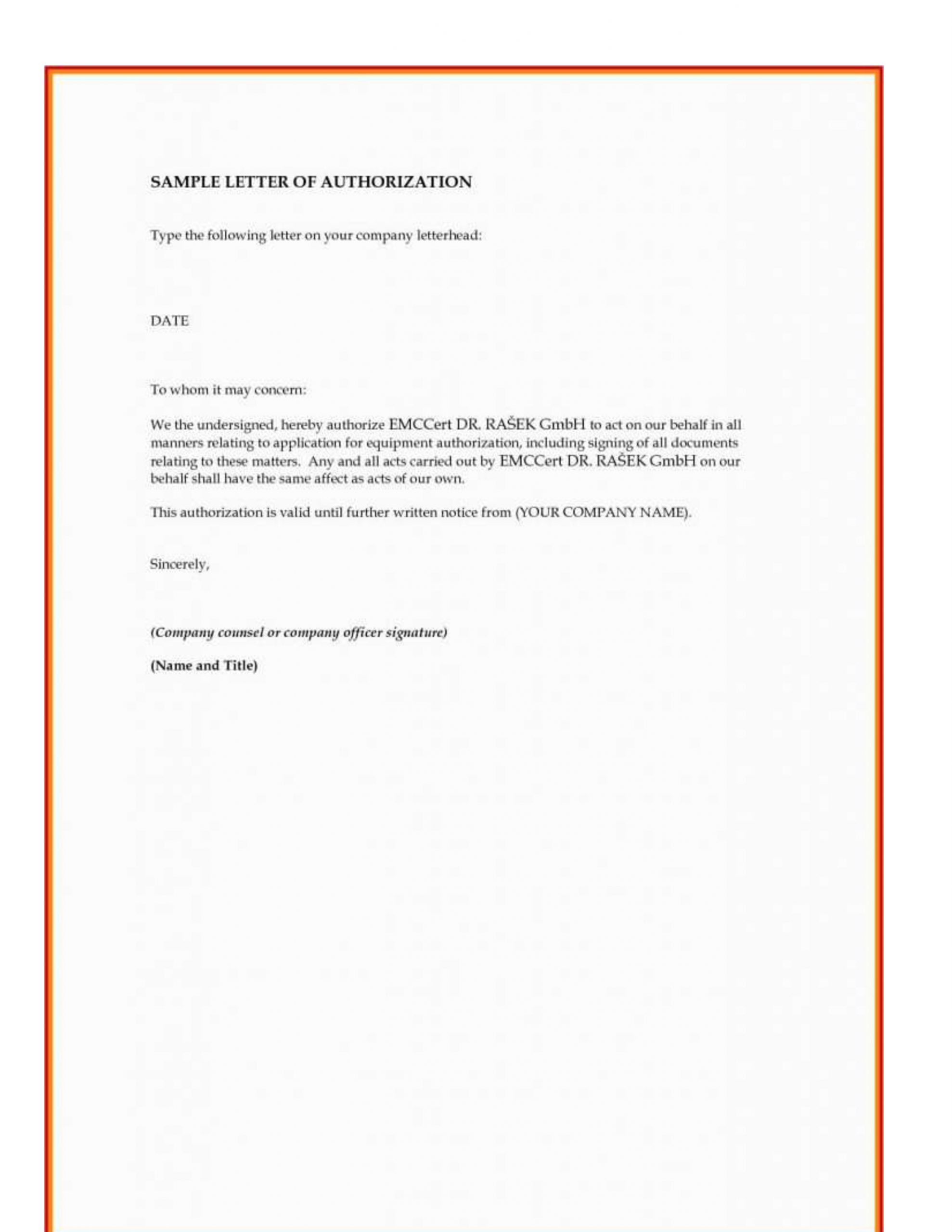

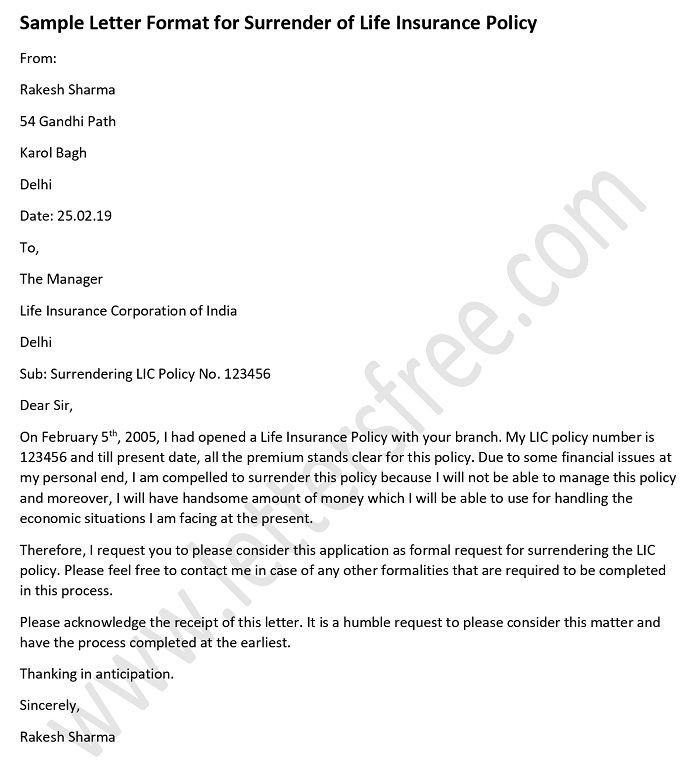

If you're hit past a lawsuit, your auto or homeowners insurance may not fully cover you. Getty Images rapid quiz: pull off you own a dog? How not quite a swimming pool or trampoline? realize you have a long commute? Are you a hunter? If you answered yes tGallery of authorisation letter to surrender insurance policy :

Suggestion : Free Download authorisation letter to surrender insurance policy Now authorisation adalah,authorization adalah,authorization artinya,authorization and authentication,authorisation app,authorisation australian spelling,authorisation authentication,authorisation and authorization,authorisation application,authorisation agreement,letter artinya,letter a,letter adalah,letter a logo,letter art,letter aesthetic,letter alphabet,letter application,letter a worksheet,letter animal restaurant,to all the boys i've loved before,to artinya,to all the boys,to adalah,to all the guys who loved me,to all the boys i loved before,to adalah singkatan dari,to and fro,to aru kagaku no railgun,to aipki,surrender artinya,surrender at 20,surrender arti,surrender artinya apa,surrender artinya adalah,surrender asuransi adalah,surrender all,surrender andra chord,surrender angels and airwaves lyrics,surrender andra and the backbone mp3,insurance adalah,insurance artinya,insurance agent,insurance agent adalah,insurance advisor adalah,insurance advisor,insurance agent job description,insurance ads,insurance authority,insurance allianz,policy adalah,policy artinya,policy analysis,policy analyst,policy and procedure,policy advocacy,policy analyst adalah,policy analysis adalah,policy assimilation,policy and governance review Free

0 Comments